IOT driven BFSI transformation

IOT driven BFSI transformation

ABSTRACT

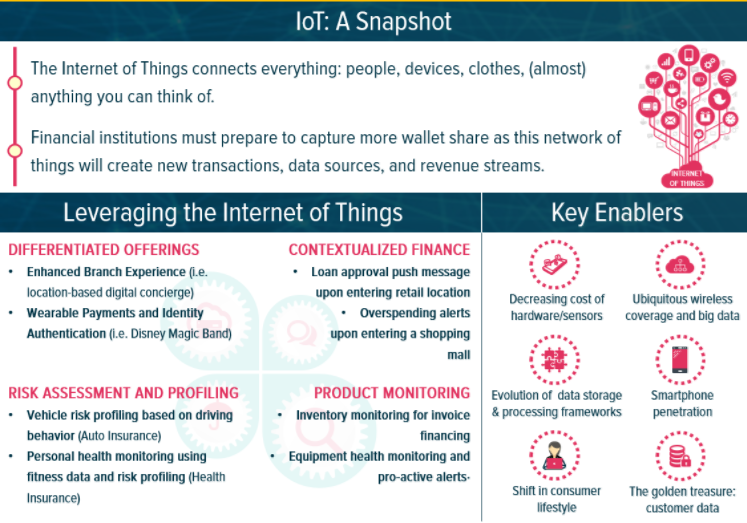

Gone are the days when customers used to stand up in the lines to request for account opening, request for cheque books and get their passbooks printed or to get account statement. It is no more like before now customers can do all these tasks online and along with this, they can buy insurance policy and pay their bills online. The Internet of Things (IoT) is the next big and imminent thing in financial services. It is a network of connected devices through the Internet, which receive and send data. Consumers can get benefit from credit facility with credit cards. Trading and share market facilities are available online. All thanks to the IoT. In this whitepaper, we discuss how IoT will help financial and banking services bring more value to customers.

PROBLEM STATEMENT

IoT still has so much to plan on investments, commercial banks, insurance companies, mutual funds, non-banking financial companies and whatever additional fields BFSI and Fintech. IoT can be used to enhance customer experience and make systems more secure against information attacks, frauds and scams. IoT technologies help to improve security by detecting and preventing fraud even before they occur. With IoT, customer experience can be enhanced because the technology helps to reduce queues at the banks; it also guides customers on how to carry out self-service with the help of a virtual assistant.

BACKGROUND

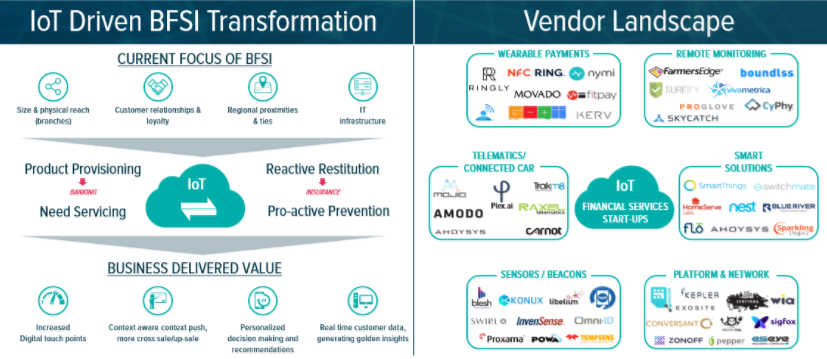

IoT is already in action in both BFSI and Fintech industries with so many user-friendly devices like machines for printing pass books, ATMs, Swipe machines and token generating machines. Along with machines there are so many software, websites and applications which made customer’s life easy like online trading apps, digital locker system, internet banking and one time password (OTP) facility for secure transactions which not only ensured security but also gained customer confidence.

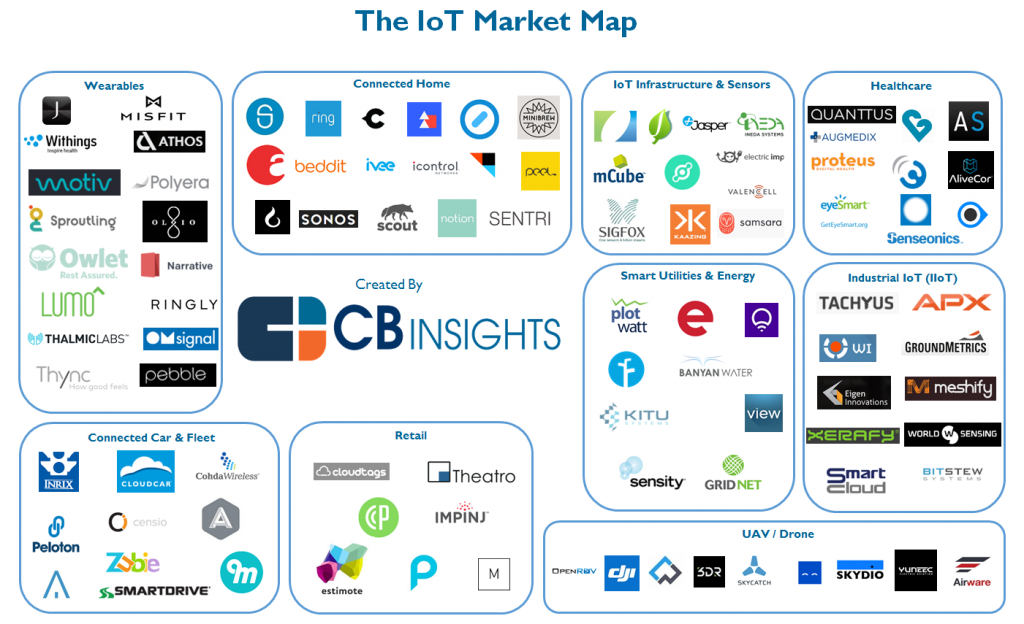

Billions of devices are connected to each other, and in doing so, become an intelligent system of systems. When these intelligent devices and systems share data on the cloud and begin to analyze, they can transform our business, our lives, and our world –in countless ways.

Customers use smart devices for accessing data, which allows banks to provide a complete view of customer finances in real time. Banks can anticipate the needs of customers through the data collected and offer solutions and advice that can help customers take sound and smart financial decisions. In this way, the ‘bank of things’ can become a very powerful facilitator to increase customer loyalty, and in turn, bring in more business to banks.

In the world of interrelated ‘things ’, banks are communicating with customers, offering them advice via their cell phones. A similar approach can be taken with regard to the spending habits of customers. There are multiple ways for banks to connect with their customers –by offering advice and rewards in other areas of life, not necessarily financial. This, in turn, will increase customer loyalty.

IoT has huge potential to impact the banking and financial services, customer experience and lifestyle as these industries deal with data processing, massive data transfer and data gathering. In a very short period of time, we all get surrounded by connected devices like smartphones, censored devices and wearable tech in our home, work and public places. This helps the consumer to save time, work smarter and live a healthy and active lifestyle. But for business, there are multiple benefits from IoT. Industries like Banking, Insurance and Finance have quickly embraced the benefits of IoT innovation.

The banking industry has taken the opportunities to develop many new ways to collect the valuable data of customer through smart and sensor devices. IOT technology has empowered the banking and finance industry technologically to assist their customer and help them to achieve a better commercial result. Internet of things like Biometric and a Positional sensor is helpful to the banking industry to track the quality control in a better way and to take a vital decision on business leading to stay ahead of the curve.

During the COVID-19 pandemic, IoT becomes much more effective than ever before as it seems to be the best possible solution for continuous operations of these industries. People used smart payment options instead of cash payments and used internet banking for issues which ensured less possibility of infection.

In early 21st century when whole the world witnessed crises like the “subprime mortgage” crisis in the United States, and the “Great Recession”, that began in 2008 and gave a huge setback, along with other industries the global BFSI and Fintech Industries also faced serious turmoil. In these tough times it was IoT which attracted the consumers and helped these industries to come back on track.

Fintech is considered as the birth of modern-day technologies in financial services with cryptocurrency and blockchain. Although both are different but when all these three are combined in any application then these can deliver new kind of financial services like transformed financial trading.

SOLUTION

Customers experience is very important for any industry and so is for BFSI and Fintech. In the times of google, apple, Facebook, amazon and other social sites traditional financial services are facing problems to match with technology but IoT can provide the ways through which these can improve on tech part as well. Other than customer experience security, speed and active lifestyle are also important.

IoT can provide so many facilities few are listed below:

Personalized marketing: Because of so much gathering of data and its processing it becomes much easier for the industries or banks to find out what does a particular segment of customers want. Insurance companies keep an eye on their customer’s expenses and can suggest suitable policy.

Product planning and management: By keeping an eye on consumer’s activities industries can plan for their products and can provide better products according to consumer’s requirement. It also helps at management level where they have to manage the budget and product scope.

Security solutions: With the introduction of biometric signatures security has reached to a new level. Likewise, OTP (One Time Password) feature is also very useful to stop any fraud and scam. Banks are using cameras, motion sensors and smart sensor which can detect smoke and gas by this way they can secure their branches from any accident.

Monitoring and tracking systems: Banks and finance industries can track and monitor their customer’s online activities and can set the limit and block account if set limit is exceeded. Also, they can block the transaction in case of any intrusion or security threat.

Proactive services: With IoT technology banks can immediately know about any fault in the system any can respond instantly to that. So, this makes happy relationship between bank and customers. Banks also have their consumers previous data so if something suspicious happens they can know about that and can respond accordingly.

We at Encoding Enhancers also understands the need of IOT for various processes in the industry. We believe that even though the IOT is not the ultimate solution for the problems faced by industries, but it is the best alternative that provides that best working efficiency.

We work with several companies to design, develop & deliver IoT products for commercial, industrial and home use. We have done several projects in domains like Leak Detection, Heat Tracing etc. We provide IOT solutions for various industries to help them cope with the difficult times.

We have developed products using several development boards from NXP, TI, ESP32, Arduino, etc. That includes low level peripheral driver development and firmware development for our products. We are experienced in developing memory, power and speed optimized applications.

CONCLUSION

IoT provides more data which means better decisions. It reduces the workload with automation and has ability to track and monitor the things. It increases efficiency by reducing money and cost to provide better quality of life. Such has been the impact of IoT in BFSI and Fintech that it has vast possibilities in future as well. The increased use of devices by customers has led to an increase in IoT data. IoT will transform lives and change the way business is undertaken. Today, everything is connected, wireless, or being wired up. Banks have to convert IoT data into valuable information, and thus, increase their market share and provide better services to their customers.